Four ways data lineage powers BCBS 239 compliance

A quick recap of BCBS 239

BCBS 239 is an important standard created by the Basel Committee on Banking Supervision published in 2013 to improve how banks and financial institutions manage risk data. It helps organizations gather, combine and report risk information effectively, which leads to better decision-making and greater resilience during stress.

Key aspects of BCBS 239

The framework comprises 14 principles that focus on four primary areas:

- Governance and infrastructure: Institutions must establish a robust governance framework for risk data management, integrating it into their strategic priorities

- Risk data aggregation: Accurate and timely data aggregation is essential for understanding exposures, especially during market stress. Ineffective aggregation can hinder responses to emerging risks

- Risk reporting: Reporting must be clear, concise and actionable, providing decision-makers with accurate insights to manage real-time risk

- Supervisory review: Compliance is mandatory and subject to regular review by supervisory bodies. Non-compliance can lead to penalties and increased oversight, affecting operational and financial flexibility

Four ways data lineage powers BCBS 239 compliance

Data lineage plays a critical enabling role in supporting all four primary areas of BCBS 239 compliance—governance and infrastructure, risk data aggregation, risk reporting and supervisory review:

- Governance and infrastructure: Data lineage enhances governance by providing transparency into data flows, transformations and responsibilities across the data lifecycle. This helps ensure data ownership is clearly defined and that governance frameworks are enforceable. Institutions with mature data lineage capabilities are better positioned to implement and audit control frameworks, as required by BCBS 239 Principles 1 and 2 (governance and data architecture)

Business benefits:

- Stronger accountability: Clear assignment of data ownership improves decision-making and compliance

- Regulatory confidence: Demonstrable governance improves the institution's credibility with regulators

Technical benefits:

- Simplified audits: Automated lineage tools reduce time and effort to trace data flows.

- Improved change management: Understanding dependencies minimizes risk during system, process or data changes.

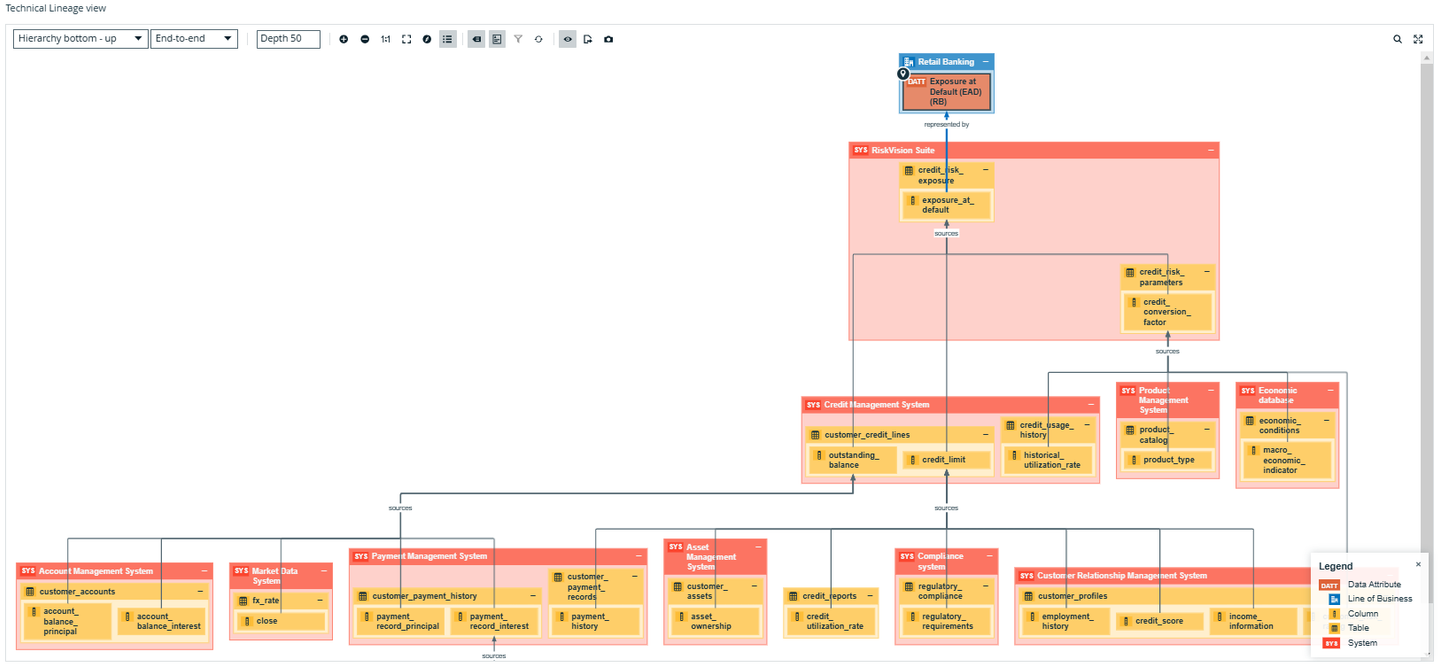

Figure 1: Data lineage across technical infrastructure

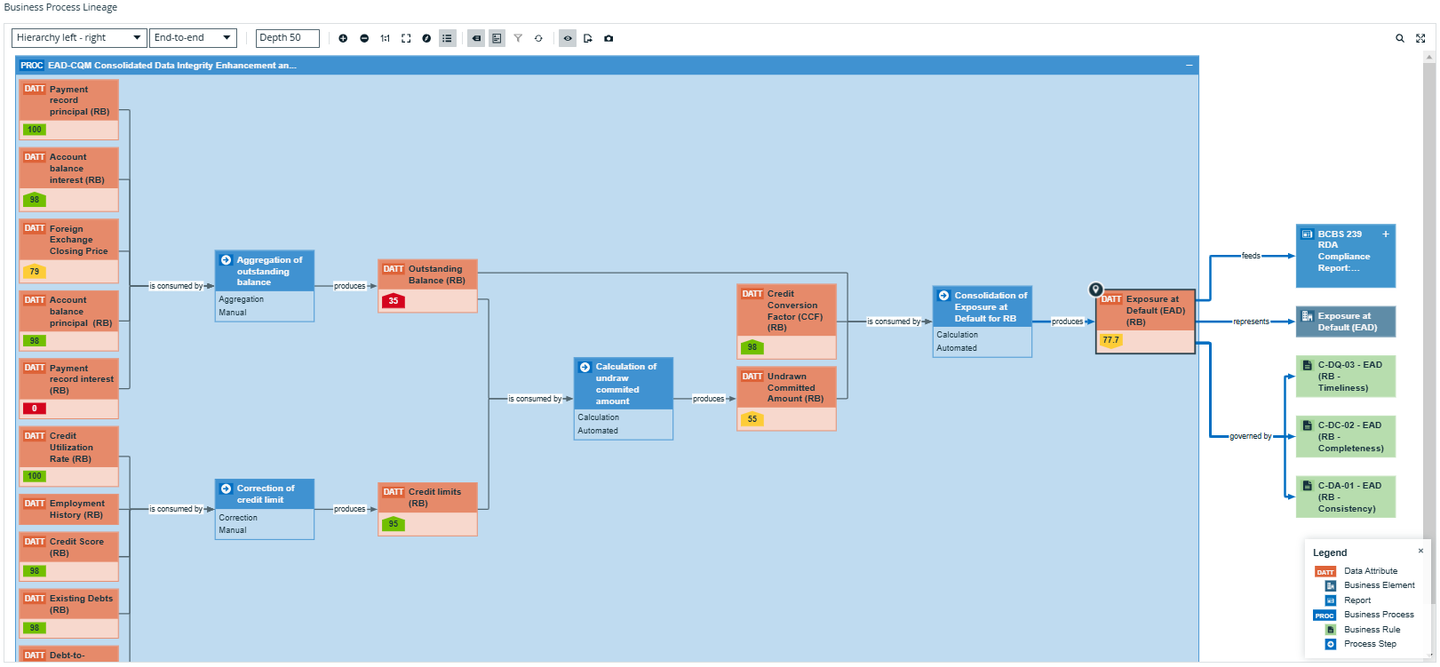

2. Risk data aggregation: Effective data lineage supports risk data aggregation by enabling banks to trace risk exposures back to their source systems, validate data accuracy, and correct inconsistencies. This capability directly supports compliance with Principles 3 to 6, which emphasize accuracy, integrity, completeness, and timeliness. Lineage helps reduce reliance on manual reconciliations and improves the automation of aggregation processes.

Business Benefits:

- Faster insights during crises: Real-time visibility into risk exposures enables quicker, more accurate decisions.

- Lower operational risk: Fewer manual reconciliations reduce the chance of errors.

Technical Benefits:

- End-to-end traceability: Enables validation and reconciliation from source to report.

- Data quality assurance: Helps detect and correct data issues at the source by showing transformation paths.

Figure 2: Data lineage for the risk data aggregation process

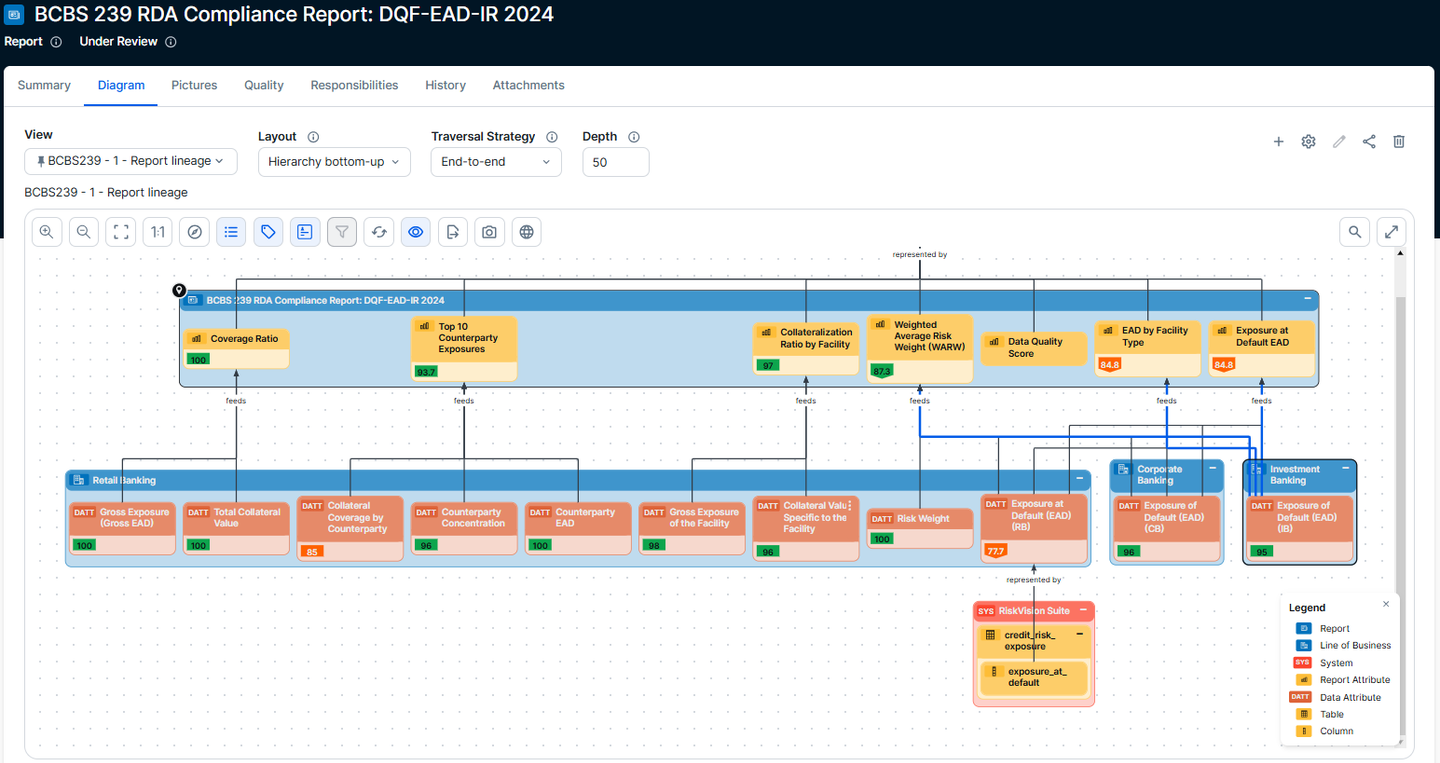

3. Risk reporting: For reporting to be timely, accurate, and useful (Principles 7 to 9), institutions need to trace reported metrics back to original data points. Data lineage ensures that report consumers can understand the origin and transformation of the data, increasing trust and aiding in auditability. This is particularly critical during stress scenarios where rapid and reliable reporting is essential.

Business benefits:

- Enhanced trust in reports: Traceable data supports the integrity and credibility of risk reports for internal and external stakeholders.

- Timely compliance: Speeds up regulatory submissions and reduces risk of penalties.

Technical benefits:

- Streamlined report generation and maintenance: Simplify report creation with full traceability of data sources, assets and attributes.

- Audit-ready reporting: Lineage metadata facilitates quick response to regulatory or internal audit queries.

Figure 3: Report attribute data lineage for compliance reporting

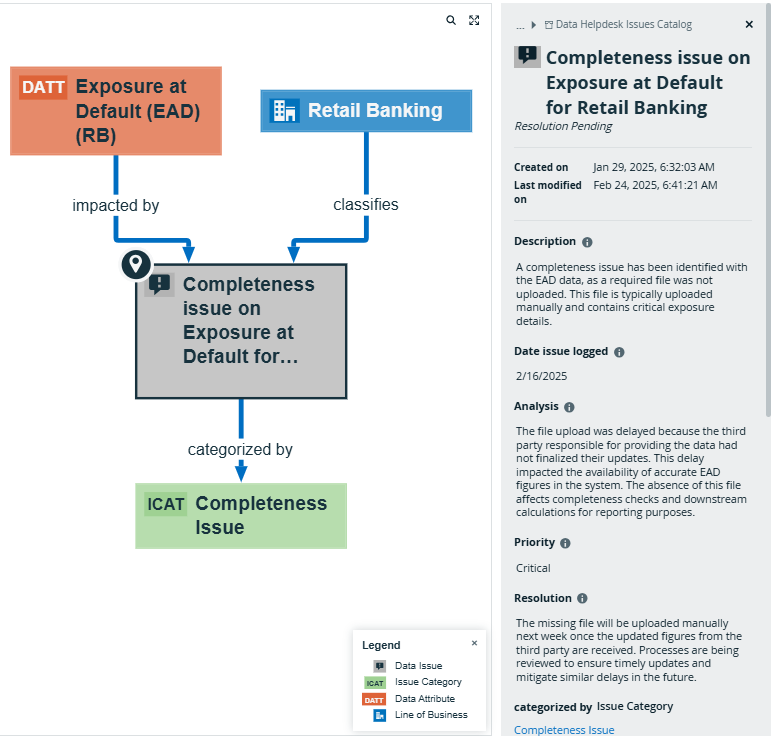

4. Supervisory review: Supervisors increasingly require institutions to demonstrate the effectiveness of their data frameworks, including through on-site inspections and fire drills. Data lineage provides the audit trail necessary for these reviews, allowing regulators to verify that data is managed in accordance with BCBS 239 principles. The ECB has used data lineage exercises as part of thematic reviews to assess credit and liquidity risk reporting capabilities.

Business benefits:

- Proactive risk management: Enables institutions to respond promptly to regulatory inquiries or stress tests.

- Fewer supervisory findings: Reduces gaps and weaknesses detected during on-site reviews.

Technical benefits:

- Fire drill readiness: Supports simulation and stress test exercises with verifiable data paths.

- Centralized visibility: Allows supervisors to assess data flows without needing to access source systems directly.

Figure 4: Data lineage for issue management and supervisory review

Summary

Data lineage is essential for BCBS 239 compliance, as it supports the framework's four core areas: governance and infrastructure, risk data aggregation, risk reporting, and supervisory review. It enhances governance by clarifying data ownership, enabling enforceable control frameworks, and increasing accountability and regulatory confidence. For risk data aggregation, data lineage allows you to trace exposures to source systems, validate accuracy, and address inconsistencies, reducing operational risk and providing faster insights during crises. In risk reporting, it ensures reports are accurate, comprehensive, and useful by offering traceability, fostering trust, and simplifying audits. For supervisory review, data lineage provides the audit trail regulators need to verify compliance, improving readiness for reviews and offering centralized visibility to supervisors.

Collibra Data Lineage can help you with BCBS 239 compliance

Collibra has collaborated with many financial institutions to enhance BCBS 239 compliance. Data lineage is often identified as the primary challenge because it underpins so many compliance activities.

Organizations that have partnered with Collibra have achieved the following benefits:

- A 58% reduction in the risk of regulatory fines and scrutiny.

- A 34% reduction in the time required to address data quality issues.

- A 57% reduction in the time needed to provide information for compliance audits.

Learn more

- Request a demo to see how Collibra Data Lineage can help you with BCBS 239 compliance

- View our webinar to hear how we’ve helped Financial Services organizations with BCBS 239 compliance

Related articles

Keep up with the latest from Collibra

I would like to get updates about the latest Collibra content, events and more.

Thanks for signing up

You'll begin receiving educational materials and invitations to network with our community soon.