Three data-driven trends to watch in financial services in 2022

The financial services industry has had a longstanding tradition of being at the forefront of adopting new technologies. It is this commitment to drive innovation, improve customer experiences and increase operational agility that has helped the industry weather some of the roughest storms. As we look towards 2022, here are three data-driven trends that will continue to shape the industry.

Trend #1: From hybrid to multi-cloud

Financial institutions operate in a highly complex data landscape, with petabyte-scale data residing across thousands of data sources, spread across on-premises and multi-cloud environments. Given stringent regulatory stipulations, data sovereignty and data governance requirements, most financial institutions have taken an incremental and multi-pronged approach to cloud migration and data modernization. For instance, many have opted for private cloud for mission-critical applications and public cloud for all other types of workloads.

It is predicted that 2022 will be another banner year for cloud data modernization initiatives with a few noticeable shifts. According to industry experts, approximately 60% of financial institutions will pursue a multi-cloud strategy in order to mitigate long-term risks and prevent vendor lock-in. They will continue to adjust the distribution of data and workloads between private and public cloud, based on changing business needs and cost considerations. For instance, there will be greater migration of use-case specific workloads to the public cloud.

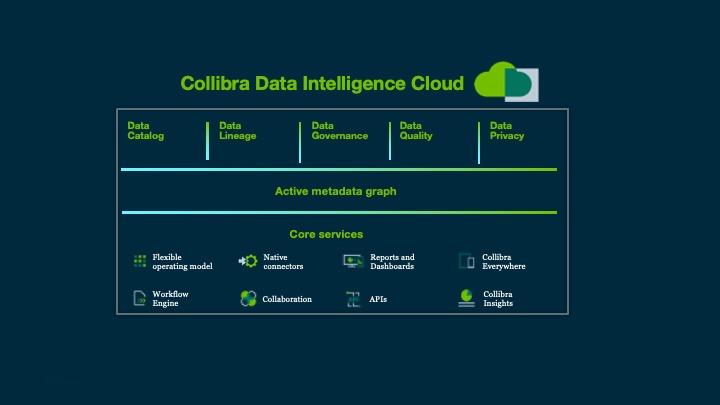

To reduce some of the inherent complexity in the data landscape, financial institutions will require an intelligent data platform with a holistic and integrated approach to cataloging, governing, protecting and managing data at scale across on-premises and multi-cloud environments. A common foundation for data will enable them to mitigate operational risks, ensure compliance with regulatory stipulations while democratizing the use of trustworthy data to speed innovation.

In a recent webinar titled “ Maximizing Value from Cloud with Data Governance”, speakers from Deloitte and Collibra shared best practices for driving successful cloud migration initiatives. For instance, financial institutions will require:

- An intelligent data catalog, with rich business and technical context to easily find and understand the data they have regardless of where it resides.

- Comprehensive built-in governance, coupled with machine learning (ML)-enabled data quality and protection capabilities. This will help ensure data is fully governed for use and in compliance with privacy policies and regulatory stipulations.

- An active metadata graph and end-to-end data lineage to easily visualize the flow of data from source to target, as well as understand all the data dependencies at a granular level. For instance, users can quickly determine what impact migrating a particular dataset may have on upstream and downstream systems, as well as prioritize migration of datasets in the right sequence.

Trend #2: AI goes mainstream

The use of Artificial Intelligence (AI) is fast becoming ubiquitous. According to Gartner, practically every application and business process will leverage embedded machine-learning algorithms, or robotic process automation (RPA), to enable hyper-automation and intelligence at scale. The list of use cases where AI is applicable is expansive – including algorithmic trading, risk calculation, fraud, anti-money laundering (AML), cybersecurity, and more.

To drive successful AI initiatives at scale, financial institutions will require a comprehensive AI governance strategy as a foundational pillar. Since AI relies on data, the integrity and quality of the underlying data upon which AI models are trained is critical to ensure accuracy and remove the risk of model bias.

Moreover, AI initiatives must be treated as a continuous and iterative process – from data preparation and training models, all the way to deployment. It is a team sport that requires a cohesive approach to discovering, validating and collaborating on data. For instance, Credit Suisse is using Collibra Data Intelligence Cloud to democratize the use of data and speed time to insights.

Stringent regulatory stipulations will require financial institutions to provide comprehensive reporting with end-to-end visibility into the AI governance process including:

- Where did the data originate from, with complete lineage of actions taken on datasets?

- Is the data trustworthy and fully governed for use?

- Does it contain sensitive information?

- What data governance, data quality and privacy policies were enacted to ensure data integrity?

Trend #3: New regulations on the horizon

The regulatory landscape will undergo significant changes over 2022-2024, with amendments to existing regulations and the emergence of new ones. For instance, Fundamental Review of the Trading Book (FRTB) and International Financial Reporting Standard (IFRS-17) will have far reaching implications on banks and insurers globally.

Both necessitate the implementation of a comprehensive data management and governance strategy to meet stringent rules and reporting guidelines. For instance, in the case of FRTB, banks will have to measure the risk associated with their trading books and raise their capital reserves to support those risks. Adherence to FRTB rules will require them to aggregate massive amounts of data from disparate internal and external data sources, create a consistent data taxonomy, and address underlying data quality issues. It will also require end-to-end data lineage to trace the lineage of risk factors and modify risk models as needed.

Next Steps:

To learn more, I would like to recommend the following webinars: Vanguard Evolves Data Governance to Drive Growth and Moody’s: Data Lineage: Get the Full Story Behind Your Data.

Keep up with the latest from Collibra

I would like to get updates about the latest Collibra content, events and more.

Thanks for signing up

You'll begin receiving educational materials and invitations to network with our community soon.