Solvency II, solved: 3 ways Collibra builds lasting compliance

Solvency II is the EU’s risk-based standard for the insurance industry, a critical regulation that safeguards policyholders and stabilizes the market. At its core, it’s a data-intensive directive that demands firms prove their financial health with complete transparency and control. This is where a strong data strategy becomes non-negotiable.

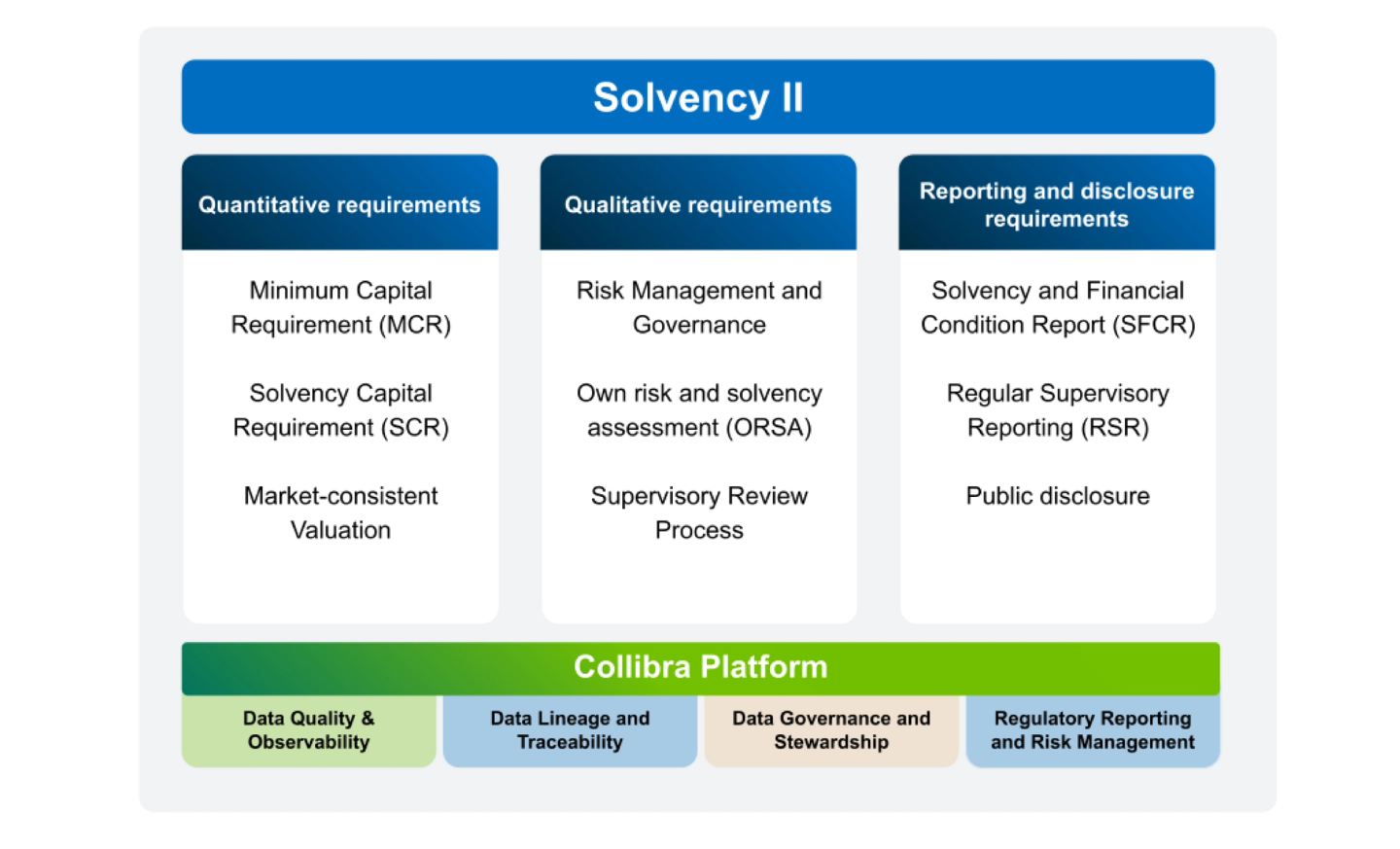

Collibra provides this foundation, enabling insurers to master their data and meet regulatory demands with confidence. Below, we break down how Collibra supports each of the three pillars of Solvency II:

Pillar 1: Quantitative requirements

Pillar 1 focuses on the quantitative requirements of the regulation, specifically the calculation of your capital holdings like the Solvency Capital Requirement (SCR) and the Minimum Capital Requirement (MCR). These figures are a direct reflection of your risk profile, and regulators require a clear, auditable trail to validate them. This is why data integrity is so critical; for these calculations, the 'garbage in, garbage out' principle means that any inaccurate input data can lead to non-compliance.

Collibra ensures the data feeding your risk and AI models is trusted, transparent and traceable.

- Data Lineage: Instantly trace data from its source all the way to your final reports. Collibra gives you the answer instantly. It maps the entire journey of your data, from its origin system, through every transformation, to its final place in your risk models. This end-to-end visibility is crucial for validating calculations and satisfying auditors.

- Data Quality & Observability: Collibra helps you define and proactively monitor data quality rules. Implement and monitor data quality rules directly on your critical data elements. This proactively catches errors, ensuring the data fueling your capital calculations is accurate and reliable.

Collibra ensures every number in your calculations and reports is fully traceable and defensible, eliminating regulatory doubt.

Pillar 2: Governance and supervision

Pillar 2 requires you to prove you have a robust system of governance and risk management, famously captured in the Own Risk and Solvency Assessment (ORSA). This pillar scrutinizes how you manage your business and its risks. It demands a robust governance framework, clear accountability and auditable processes.

Collibra is built for this. It operationalizes data governance, turning abstract policies into tangible workflows:

- Governance and Stewardship: Collibra allows you to formally assign ownership for critical data assets (e.g., policy data, claims data, investment data). By appointing Data Stewards and Owners within the platform, you create a clear, enforceable structure of accountability.

- Workflow Automation: Collibra's workflows automate processes for approvals, data change requests and issue resolution. Each step is logged, creating an immutable audit trail. This provides concrete evidence to regulators that your governance framework is not just a document on a shelf but an operational reality.

- Policy Management: Collibra can serve as a central repository for data-related policies and standards. Crucially, you can link these policies directly to the data assets they govern, making the connection between rules and reality explicit.

Pillar 3: Reporting and disclosure

Pillar 3 mandates regular public disclosure through reports like the Solvency and Financial Condition Report (SFCR). These documents are your public testimony to financial health, where any inconsistency can damage your reputation and attract regulatory scrutiny.

- Business Glossary: What does "net written premium" really mean? A business glossary ensures everyone, from IT to the C-suite, is speaking the same language. By establishing a single source of truth for all business and reporting terms, Collibra eliminates ambiguity and ensures consistency across all disclosures.

- Reference Data Management: Your reports are full of codes for countries, currencies, risk classes, etc. Collibra provides a central place to manage and govern this reference data, preventing inconsistencies that can lead to reporting errors and regulatory headaches.

- Data Lineage (again!): When a regulator points to a number in your SFCR and asks for its origin, you can instantly show them the full lineage, demonstrating complete transparency and control over your reporting process.

Solvency II isn't just about proving you can meet your promises; it's an opportunity to build a better business. Collibra provides a unified platform to ensure your data is high-quality, fully traceable and managed with clear accountability, allowing you to meet regulatory demands with confidence.

Ready to simplify your Solvency II journey? Request a demo of Collibra today to see how our platform can help you navigate the complexities of regulatory reporting with confidence.

In this post:

Keep up with the latest from Collibra

I would like to get updates about the latest Collibra content, events and more.

Thanks for signing up

You'll begin receiving educational materials and invitations to network with our community soon.